The Healthcare Sector & Insurance System With Bank

|

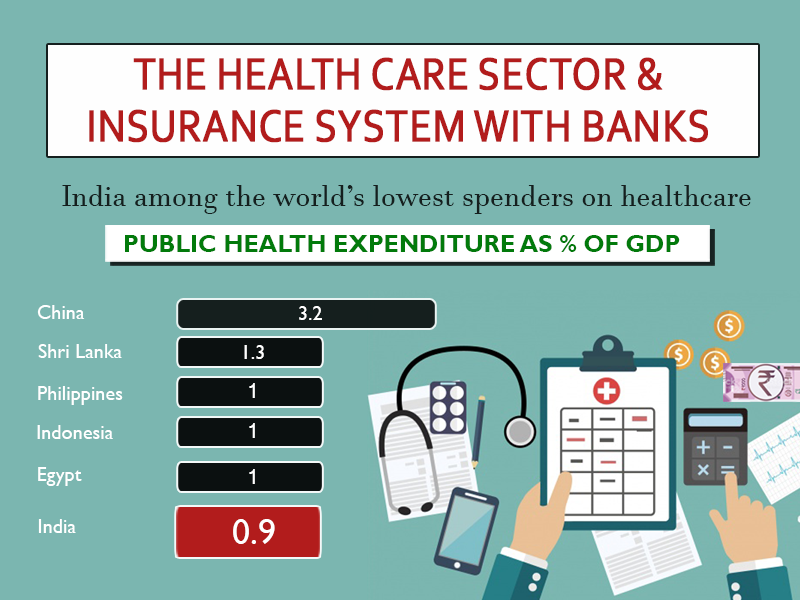

Although India, has a legacy of centuries-old heritage of medical science, problems like higher population density, low socio - economic status of a significant number of people and low literacy rate in some parts of the country, have resulted in poor health indicators. Recently, in a research article published by the Niti Aayog it summarised that, India’s health insurance system is presently so fragmented that health care has become more expensive and less effective and there is a dire need of large-scale reforms so that Indians can have easy access to affordable health care.

However in the recent years, the escalating expenses for medical treatments have now dramatically contributed to the rising awareness about Insurance. This is driven by rising incomes, sedentary lifestyles and the diseases that come with it. Consequently, the insurance industry is now picking up, but is still yet to mature in terms of provisions and facilities, terms and conditions offered to the end user. The percentage of the Indian population having health insurance policies is very low, and there are very few companies offering insurance in the healthcare sector.

So, let us take a look at what exactly is going on in this sector –

Now, let us see how India’s health system is fragmented across insurance providers

> Insurance schemes have strict eligibility rules, which means that each government scheme only covers a small subset of the population

> A highly fragmented system tends to perform poorly as each organization within it operates with a different set of rules and standards.

> In particular, fragmentation in health insurance means the financial risk pool for each provider tends to be rather small, which leads to low government spending, high out-of-pocket expenditure, limited options for healthcare service providers, and inconsistent quality of service.

> In India, insurance schemes are split across several commercial, social, union-sponsored and state-level programmes. Such a system can be inaccessible to patients leading to delayed care, unnecessary expenditures and confusion over people’s eligibility for services.

Niti Aayog opines, improving the structure of government insurance schemes and expanding the risk pool – the basis of an insurance system – are key to delivering quality, timely and affordable healthcare. The think tank says the country has far too many schemes, each catering to too small a section of the population.

Ayushman Bharat Yojana – A step in right direction

Ayushman Bharat programme aims to provide Rs. 5 lakhs in coverage to the poorest 40% of the population. But Niti Aayog also identifies several existing schemes that could be streamlined to extend this support.

An example is the Employee’s State Insurance Scheme (ESIS), which covers workers earning less than Rs. 25,000 per month. The scheme is presently underperforming despite being the world’s largest such programmes because it offers limited services and has among the lowest health service utilisation rates. It is mind boggling to understand that this is despite spending only Rs. 9,200 crores of its total Rs. 2.35 lakh crore revenue in 2017-18!

Individual and family health insurance plans can help cover expenses in the case of serious medical emergencies, and help the person or family stay on top of preventative health-care services. Having health insurance coverage can save money on doctor's visits, prescriptions drugs, preventative care and other health-care services. Typical health insurance plans for individuals include costs such as a monthly premium, annual deductible, co-payments, and co-insurance. The health insurance plans offered by banks tend to be tie-ups with insurance companies, resulting in the bank being the intermediary. Insurance companies generally design special policies for the bank’s customers. Sourcing the insurance schemes trough the Bank has its own advantages-

> The biggest advantage of buying a health insurance policy issued by a bank is the substantially lowered premiums for comparable health benefits.

> Premiums for health insurance policies sold by nationalised banks tend to be very low compared to both private as well as state-owned insurance companies, especially for group cover policies.

> Generally health insurance policies are more expensive as the policyholder gets older. This is because of the added risks and chances of the policyholder getting ill. Health insurance sold by banks does not take age into account when premium calculations are done, making it more affordable for senior citizens for most cases.

> Policyholders who hold a bank account and choose to buy a health insurance policy from the bank can always choose to transfer their policy to the insurance company, if they desire. This makes these policies more attractive as policyholders can always opt to port if they are not happy with the coverage offered by the bank sold insurance policy.

> Most bank sold health policies also offer policyholders the option to increase their health cover through additional covers, which can be added on to their primary policy. In this way, policyholders can choose to as and when they require it by simply purchasing additional protection.

Finding the right plan can be difficult. Each plan has its pros and cons, especially considering how costs can vary - depending on the plan's monthly premiums, deductibles and co-pays. Earlier, health insurance was unaffordable and unavailable for many. The good news is that with the banks stepping in, this sector has now opened up for one and all to avail and benefit. With the Government’s serious focus of healthcare, the Banks provide easy healthcare schemes with all the benefits that are to offer on the platter.