Know Your Worth

30 Aug 2021 14:46:12

Introduction:

There was a time when being a millionaire meant you were wealthy. Today, there are many who cross that bracket. The term is obsolete today and a new term-of-art “high-net-worth-individual” is making rounds in the financial circles. Its acronym HWNI is thrown around with much weight to address a wealthy person that sounds almost irrefutable and unchallenging.

Rich and wealthy have become two different things in today’s world. They appear to be synonymous, but are completely different in reality. Rich is someone with high income or a lot of money in bank accounts but it certainly doesn’t mean you are wealthy. Rich may earn a lot but probably spend higher and consequently have high debts too.

Being wealthy on the other hand is not only having enough money to meet your needs but being able to afford not to work if you don’t have to. It’s about making your money work for you. In other words, it’s having a significant net worth.

Your Net Worth Is What You Own Minus What You Owe.

What Exactly Is Net Worth?

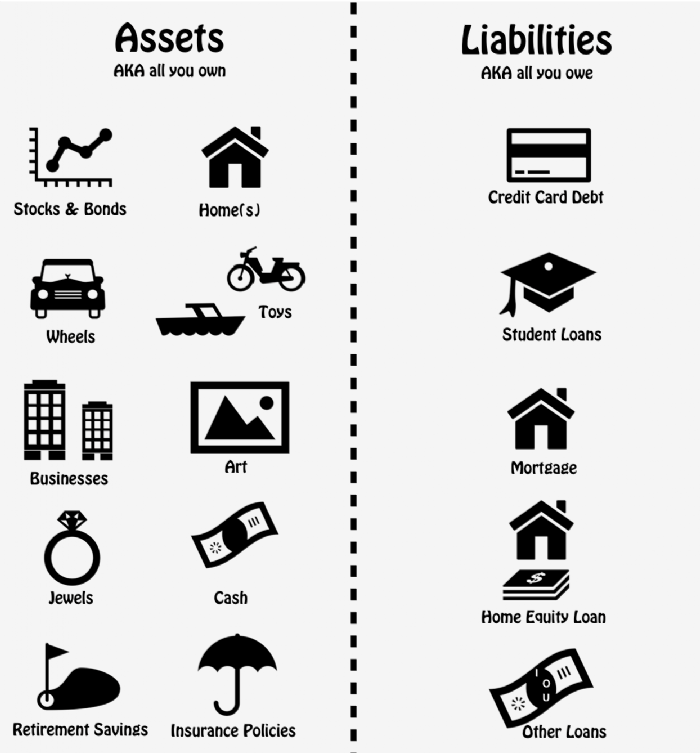

The combination of what you own (your assets) and what you owe (your liabilities) makes up your personal net worth. Your assets should always outweigh your liabilities. It is important to assess and evaluate your net worth from time to time as a) It lets you understand your current financial situation. b) It gives you a reference point for measuring progress toward your goals.

A wallet full of cash does not make you wealthy but a mind full of ideas of investment does. To have a good net worth, one should not focus on income alone but also ways and strategies to save, invest and grow with what you have in hand. A few investments that lasts you for a lifetime is the true marker of good net worth.

Calculate Your Total Assets:

List all your assets, estimate the value of each and make the total. This can include the money in your bank accounts, value of your investment portfolio, market value of your vehicles, market value of your home, personal property such as jewelry, art, and furniture, Cash value of any insurance policies, your retirement funds etc.

Calculate Your Total Liabilities:

List all your liabilities, estimate the value of each and make the total. This can include the credit card debt, mortgage loan, car loan, home loan, education loan, personal loan and other such payables. Obligations like alimony and child support too is a liability.

How to Raise Net Worth?

1. Pay Your Debts: Fewer the obligations, more the benefits of an asset.

2. Increase Income: renting out your properties, starting a side hustle, passive income from investments like dividend investing etc.

3. Add To Retirement Account Or Investment Portfolio: Steady contributions to tax-advantaged accounts can help you grow your wealth and increase your net worth over time.

4. Be A Disciplined Investor: Have systematic investment strategy and put aside money every month

5. Use Time Advantage: The sooner you start investing and the longer you remain invested, the higher the potential for return.

Benefits of High Net Worth:

HNWI category receives additional attention and customized by all money managers, investment companies and insurance advisors too. They get a personalized, exclusive array of special benefits through various premier services.

HNWI category may enjoy reduced fees, access to conferences and special events, tickets to entertainment, theatrical and sporting events, and other such places where more such people network and grow business together.

Janakalyan Sahakari Bank’s Offer to High Net Worth Individuals

Higher rate of interest is paid to High Net Worth customers for all categories of deposits in case of a single receipt of Rs.15.00 lacs